Ned-o-nomics

4. Kaizen: The Key to Japan’s Competitive Success, $222

While on a trip to Japan in 1986, Johnson checked into the Okura, a luxury hotel in the center of Tokyo, not too far from the Imperial Palace. He’d ostensibly come to visit a Fidelity satellite office, but he was also interested in talking to some Japanese business leaders, whose efforts, particularly in manufacturing and technology, had made their economy the envy of the world. Johnson had been impressed with Japanese ingenuity for years. He considers himself something of an amateur photographer—a talent inherited from his mother, who had built a darkroom in the family’s Milton home—and he’d noticed back in the ’60s that Japanese cameras were not only better than their German counterparts, but also sold for half the price. He could never put his finger on how they were doing it. At a shop in the Okura hotel, he found the insight he sought in a thick hardcover called Kaizen.

The title refers to a Japanese management philosophy that emphasizes making constant changes on the path toward improvement. No task is too small for examination: “‘Kaizen‘ means that if you sweep the building, you always want to try to do a better job—and in a shorter time,” Johnson once explained. He took to the concept with characteristic verve, hiring the book’s author, Masaaki Imai, to lecture several hundred Fidelity executives, and later writing the foreword to Imai’s follow-up book, which included Fidelity as a case study. Johnson went on to commission a kaizen-focused orientation video for new employees, and had the Japanese characters for the word painted on a scroll, which was hung in the anteroom to his Financial District office. “[Kaizen] suggests that every aspect of a business needs to be improved,” he wrote in Fidelity’s 1987 annual report (the cover of which, too, was emblazoned with the characters for “kaizen”).

The philosophy was a perfect fit for Johnson’s personality. As a boy, he used to take apart clocks to figure out how they worked, and he peppered his family’s mechanic with questions about what each car part did. He brought the same curiosity to work, introducing a series of breakthroughs that expanded Fidelity’s business and appeal. It was his idea to start letting customers conduct business over toll-free 800 numbers, for instance, and to let them write checks out of their money-market accounts (two 1974 innovations that have since become commonplace in the industry). He also launched a number of sideline ventures, figuring that dabbling in other industries would help diversify Fidelity while providing a chance to learn management practices from outside the financial services world. The inspiration for his BostonCoach livery service, which Johnson founded in 1985, came from years of being unable to get a quick taxi from Logan. “The process of having an idea and operationalizing it is a very fun thing for Ned,” says a former executive. “For some guys it’s golf, for some it’s sleeping with women who aren’t their wives. For Ned, it’s this stuff.”

At Fidelity, the chronic experimenter has been known to hire two people for the same job and then let them prove who would work best. The concept of kaizen, not surprisingly, has also been trotted out as an explanation for any number of the company’s major shakeups: when the legendary fund manager Peter Lynch departed in 1990; when Johnson moved daughter Abigail from her post as president of the mutual fund division in 2005; and when Robert Reynolds, his longtime second-in-command, left last year. To replace Reynolds, Johnson lured back to the company an old friend and confidante, Rodger Lawson, who had previously worked at Fidelity some 16 years earlier. Shortly after arriving, Lawson pushed through the largest corporate restructuring in Fidelity’s history, splitting off some of its divisions and combining others in an effort to streamline the business. While Lawson was heralded as the point man in the overhaul, the shuffling was vintage Johnson.

Given that this is a man convinced that no detail is too tiny to worry about, it should surprise no one that Johnson’s blueprint for succession remains a work in progress, something prone to change, as one industry wag observes, “as quickly as the secret numbers to launch ICBMs.” Caught between his twin devotions—to his company and to his family—Johnson figures the person best fit to preserve the legacy of both is still himself. Until that changes, tinkering with a succession plan may well keep Johnson from feeling locked into one.

But the danger of constantly tweaking, of course, is falling in love with constantly tweaking. “Listen, he’s not a god. He’s very human, and some of the skills he lacks are detrimental to his being CEO,” says the former executive. “Decision-making can be kind of slow because the experiment is the thing. I always sensed some disappointment in him when we got to the solution, because the process of problem-solving was over.”

5. 268 Acres in Research Triangle Park, North Carolina, $19.4 million

Anyone who’s ever walked by Fidelity’s headquarters on Devonshire Street knows Johnson has not been particularly interested in building monuments to his achievements. The nine-story building, dwarfed by its neighbors, makes sparse use of signs. Two small bronze plaques that read simply “Fidelity Building” flank the entrance, harking back to a time when names on buildings were used merely to mark an address.

But Fidelity’s future lies in places far away from those roots. Today, only about one-quarter of its 46,000 employees work in Massachusetts, with the rest scattered among 10 regional sites across the country. In these far-flung addresses, on sprawling, manicured new campuses, Fidelity is becoming the company that Johnson will pass on. And Johnson, it seems, is allowing himself to indulge in some preening. The two roads that wind through Fidelity’s 14-year-old Covington, Kentucky, campus are called Magellan Drive and Crosby Parkway. The former honors the company’s flagship fund, once run by Johnson; the latter borrows Johnson’s middle name. Certainly not ostentatious, but still not the type of thing you’d ever see here in Boston.

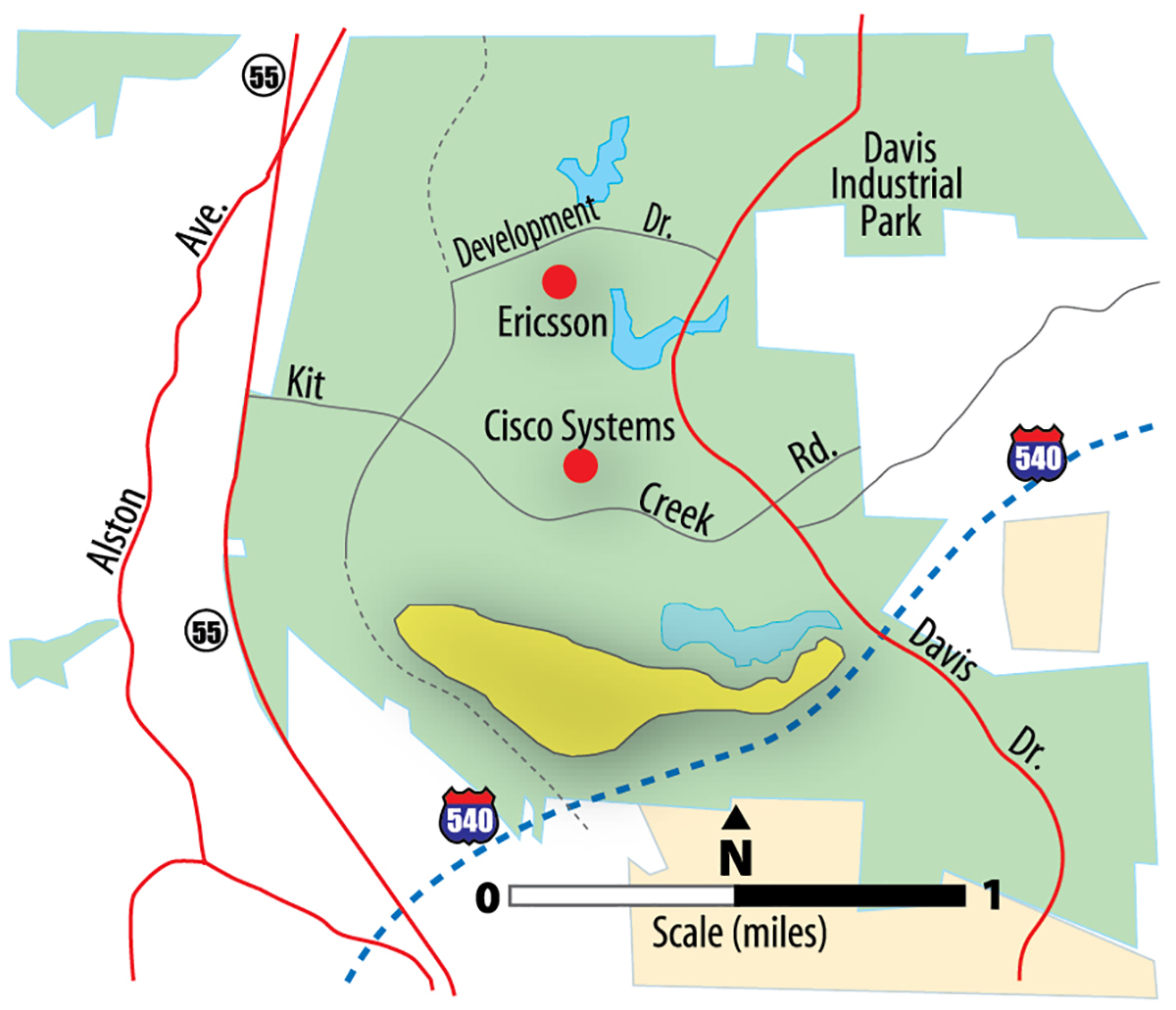

In 2005, Fidelity began quietly hunting for a spread on which to build its still-unfinished North Carolina outpost, a search that it code-named “Project Ribbit” (a nod to the company’s frog-themed marketing campaign of the 1970s). The first task was finding out where Fidelity could negotiate the best tax incentives. When it purchased its Westlake, Texas, campus in 1999, the company decided to keep the herd of cattle that came with part of the property; one year, its two dozen longhorns made Fidelity eligible for a tax break (originally intended to help struggling farmers) that slashed its annual property tax on that section of land from about $300,000 to less than $1,000. This time, the company secured itself an even sweeter deal: Two years ago, after working with North Carolina officials, Fidelity made the single largest purchase in the history of that state’s Research Triangle Park business district, picking up 268 acres for nearly $20 million. Under the terms, Fidelity has to sink $100 million into a new complex hosting at least 2,000 jobs, but for doing so it will qualify for a hefty $69 million in tax incentives.

Though Johnson stayed in the background during the negotiations, it was clear that he was directing the effort. “He was in charge of the project,” says former state commerce official Tony Copeland. “All of the Fidelity representatives clearly indicated that he was the driver—in a positive way.”

As of this writing, the company has yet to file blueprints for its new campus, much less break ground. Employees who moved from Boston to North Carolina, where they now work in temporary offices, have taken to wondering about the delay. One story passed among them is that Rodger Lawson and Johnson disagree on how the building should look. Lawson wants something generic that they could someday rent out or resell, while Johnson, who has been known to involve himself in decisions as mundane as choosing light fixtures, is looking for something unique and grand. Something befitting Fidelity’s legacy. “The corporation has a chance of infinite life,” he once told an interviewer, noting that the people who run it don’t.

On one scouting trip Johnson made to inspect the land he was buying, the ever particular CEO is said to have flashed his penchant for details—and his dedication to shaping the parts of Fidelity that will outlive him. Walking the grounds, he came upon a muddy pond. It was new and man-made, still red from the North Carolina clay it was gouged into and looking nothing like a pond he’d ever seen in New England. Johnson stopped for a moment, and then turned to his companions. Could they figure out a way to dye the water a more pleasing color? How much would that cost?