Hail, Boston: The Uber vs Taxi Livery War Is Changing the Industry

The city’s taxi battle is about to go into overdrive. In May, taxi drivers protested outside Uber Technologies’ headquarters near South Station, claiming that because Uber’s drivers weren’t as heavily regulated, they had distinct economic advantages. A couple of weeks later, the Cambridge License Commission held a hearing to determine whether the city should impose stricter regulations on the Uber-kinds (a decision was delayed pending further review). Then in June, a Boston labor lawyer filed a suit against Uber, claiming that it classifies its drivers as contract workers to avoid offering health benefits, and is illegally withholding a portion of their gratuities.

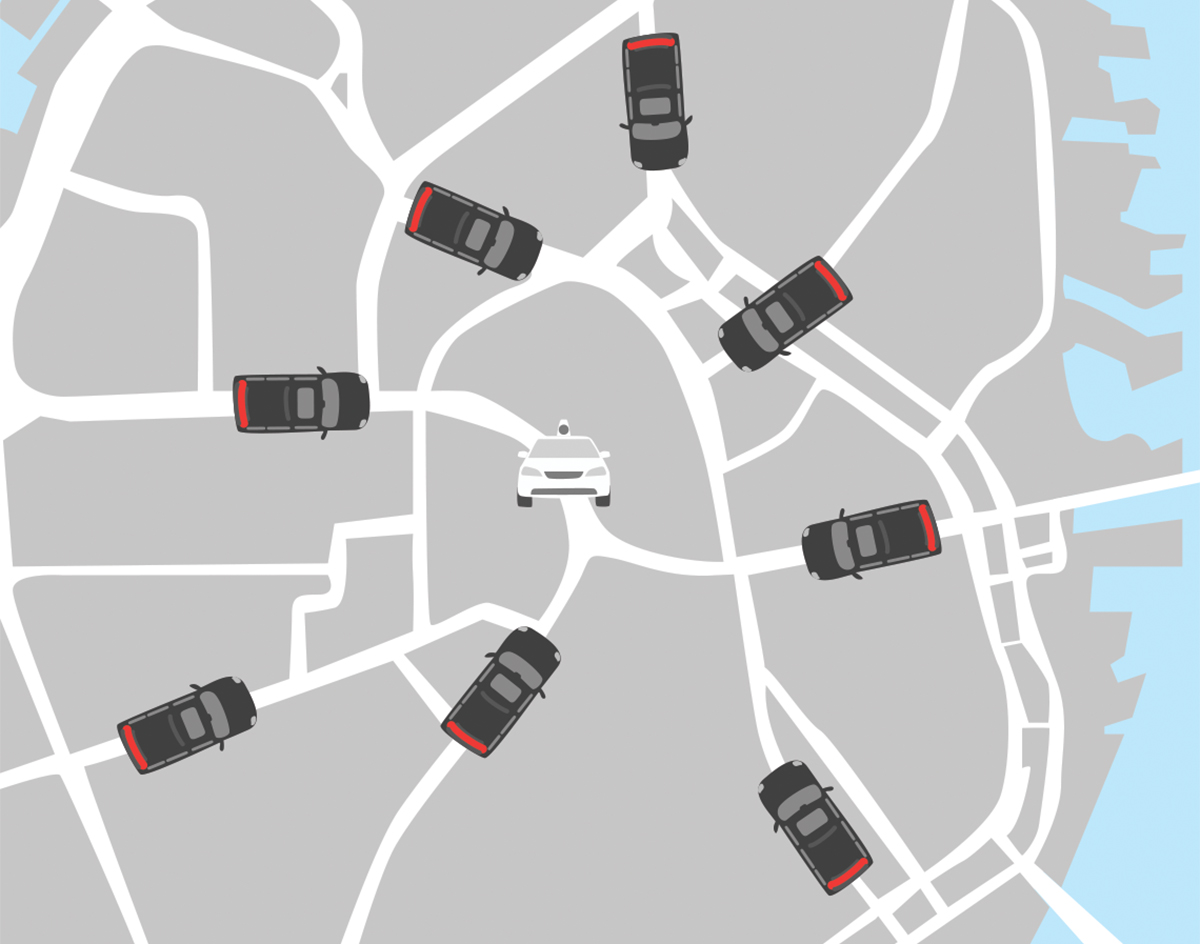

“You have one industry that is highly regulated that has established rates,” says Boston Taxi Drivers Association spokesperson Donna Blythe-Shaw, “and another industry that has saturated the streets of Boston with unlicensed, unregulated vehicles—illegal vehicles—that determine whatever the rate is based on the day and time or whatever they feel like.”

Whatever the rhetoric, who’s really being affected by the rise of app-based liveries? “At the end of the day, it’s the big taxi industry that’s slinging the mud,” Uber spokesman Taylor Bennett says.

In truth, there’s no such thing as an indie taxi company in Boston. When City Hall limited the number of medallions, it effectively squeezed out the moms and pops. Now a handful of people, like Boston Cab’s Edward Tutunjian, have cornered the medallion market, driving the cost of individual livery licenses up to as much as $700,000. In fact, most of Boston’s taxi drivers have to shell out approximately $110 a day to rent their cars and medallions.

Uber reps maintain they’re simply offering drivers—and consumers—more options. According to Uber, there’s no cost to become a partner driver, aside from maintaining and owning your own vehicle. And they claim that drivers earn up to 80 percent of every ride.

From a consumer standpoint, app-based services are more convenient (sure beats getting soaked trying to hail a cab in a downpour) and generally offer a better customer experience than taxis do (thanks to instant ratings, newer cars, and mercifully fewer olfactory enhancements). “Uber is changing the industry,” Bennett says. “Anytime you go in and disrupt the landscape like that, it ruffles the feathers of the entrenched industry that has been unchanged and uninnovative for the past 30 to 40 years.”

So why doesn’t the taxi industry develop its own universal phone-based app and clean up its act a bit? “All we’re saying is either regulate the whole industry, or have a free-for-all out there and see what happens,” Blythe-Shaw says.