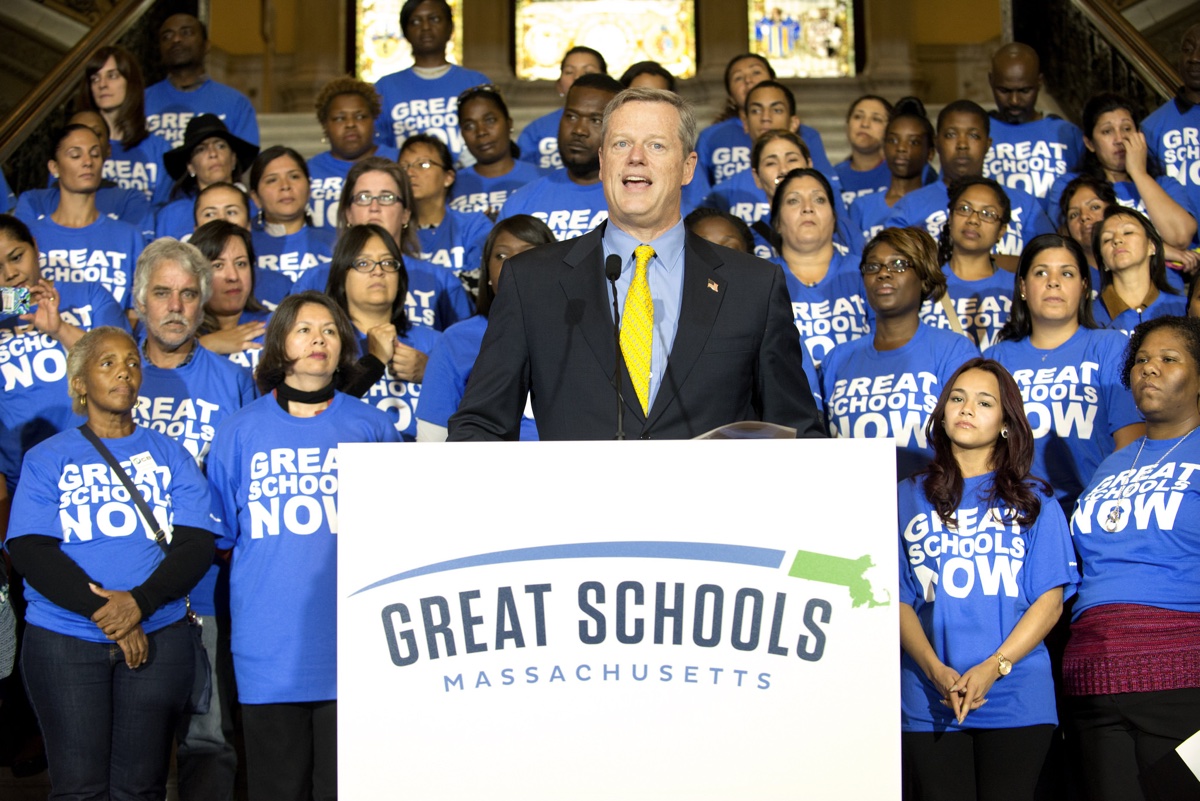

Teacher Unions Call for SEC Investigation into Baker’s ‘Possible Pay-to-Play Scheme’

Photo via Governor’s Office/Joanne DeCaro

Update: Monday, 9:45 a.m.

Madeloni and Gosnell have filed a formal complaint with the Securities and Exchange Commission, demanding the federal agency invesitgate Gov. Baker’s ties to the Yes on 2 campaign.

“Over the past year, executives of seven financial firms reportedly with contracts to manage Massachusetts state pension funds have made at least $620,000 in contributions to support ballot measure committees that support Question 2, a statewide measure on the November 8 ballot that would expand the number of charter schools in the Commonwealth,” their letter reads.

“Although their more than $620,000 in contributions have not been made to Governor Baker’s re-election campaign committee, the recipient ballot committees have paid for television ads and other public communications that either prominently feature Governor Baker or may have been developed with his involvement. Those contributions are ‘things of value’ that could influence his re-election, and, if so, are subject to the Rule.”

Baker has appeared in a new ad paid for by Great Schools Massachusetts, and has campaigned door-to-door in favor of the controversial ballot question.

Previously:

The heads of two powerful teachers’ unions have called for a federal investigation into state pension funds, after a report revealed that executives at eight investment firms tasked with managing them had contributed thousands to pro-charter groups.

An International Business Times and MapLight investigation published Wednesday found that executives at these financial firms, contracted to manage millions in public school teacher pensions, had donated at least $778,000 to groups supporting Question 2, the November ballot measure that, if passed, would lift the cap on charter school expansion in Massachusetts.

Gov. Charlie Baker, a leading supporter of Question 2, appoints three of the nine members comprising the Mass. Pension Reserves Investment Management Board, or MassPRIM, which directs state pension investments. Former securities regulator Ernesto Lanza called these contributions to Baker’s pet cause rather than Baker’s campaign fund a “version of a workaround” of federal securities law.

Barbara Madeloni of the Massachusetts Teachers Association and Tom Gosnell of the American Federation of Teachers Massachusetts released a statement Thursday demanding that state authorities, as well as the federal Securities and Exchange Commission, investigate a “possible pay-to-play scheme.”

“This is about the integrity of our pension investments and the integrity of our elections,” Madeloni said. “We need an investigation to find out whether these firms are wielding inappropriate influence in state government. These disclosures are an indication of the degree to which forces seeking to undermine our public schools are spending huge sums to promote Question 2.”

The eight investment firms named in the IBT/MapLight report, whose executives made donations to pro-charter groups, were Fidelity, Summit Partners, Highfields Capital, Berkshire Partners, State Street, Bain Capital, Apollo Global Management, and Charles River Ventures.

“Retirees need to know that investment decisions are being made based on their financial security, not to curry favor with Governor Baker and his pension board appointees,” Gosnell said.