Single-Family Housing in Metro Boston Is Affordable to Average Family

Everyone is talking about the high cost of housing. But, if you live here, you should be able to afford to buy a home in Boston right now—at least that’s what Jed Kolko, chief economist of Trulia, thinks:

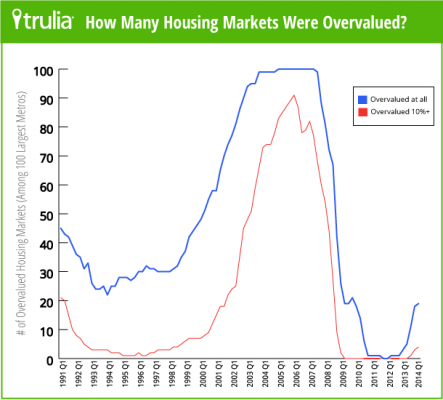

Affordability has worsened in the past year, as home prices have climbed faster than incomes and mortgage rates have risen. But compared with the longer-term past, homeownership still looks relatively affordable: home prices are still undervalued and mortgage rates remain near historic lows. In most U.S. markets, the majority of homes for sale are within reach of the middle class, and buying is cheaper than renting in all of the 100 largest metros.

His thinking goes like this:

• A middle-class family in the Boston metro area has a median income of $67,540;

• Homes under $332,000 are “within reach” of the middle class in Boston (this means that the monthly cost of homeownership makes up 31 percent or less of the household’s monthly income);

• Of the homes listed for sale today in Boston, 41 percent are within reach of middle class.

Here are the qualifiers:

• This is “Metro Boston,” which, if I read Trulia’s notes correctly, means the Boston Metropolitan Area, defined by the US Census Bureau as including “Essex, Middlesex, Norfolk, Plymouth, and Suffolk counties in Massachusetts and Rockingham and Strafford counties in New Hampshire.” So, as far south as Quincy, as west as Bellingham, and as north as Portsmouth, NH;

• This is “Household” or “Family” income which means there’s likely 2 adults earning a salary;

• These are single-family homes, only (does not include condominiums);

• Trulia considers housing to be affordable to a middle-class household if the total monthly payment—mortgage, insurance, and property taxes – is less than 31 percent of the metro area’s median household income, which means if you live in a town with a high property tax (and who doesn’t?), you’ll need to adjust your total monthly payment upwards.

How big will that “median affordable house” be? Trulia has done the math and figured it will be around 1,250-square feet, which, depending on your perspective (and, the size of your family), will sound spacious…or cramped.

While their data seems legit, analyses such as Trulia’s are of limited use to most people. We live in Boston, not Metro Boston; we buy and sell condos, not single family homes; and many of us are single, not wed in holy matrimony—so “family” income isn’t relevant or helpful.

Next week, prior to the release of April condo sales data, we’ll start a two-part analysis of how home values are calculated by two of the most-famous data collectors, the Standard & Poor / Case-Shiller and the Warren Group. And, I’ll offer up a new method of collecting data that will give us Bostonians a better idea of how the local real estate market is doing.

Trulia+Middle+Class_100+Metros_May2014 (1)